Dubai, UAE – May 24, 2025

Driving in Dubai does not only entail compliance with speed limits posted on signs but also familiarity with the grace speed margins that influence traffic fines. As of 2025, Dubai still retains the grace speed limit that provides drivers with a buffer over the posted speed before the authorities begin imposing penalties.

In Dubai, the buffer speed limit is the speed in excess of published speed prior to detection by the radar cameras. Typically, the buffer is 20 km/h to 30 km/h on a specific road. For instance, if a road is posted for 80 km/h, the radar only catches an offense at speeds greater than 101 km/h.

Below is a list of some of the roads in Dubai along with the speed limits and the thresholds for radar control:

Al Nahda Road : Limit 80 km/h. Radar Activated at 101 km/h

Damascus Street: Limit 80 Km/h. Radar Activated at 101km/h

Al Quds Street: 80 km/h. Radar Activated at 101 km/h

Sheik Zayed: 120 km/h. Radar Activated 141 km/h

Emirates Road: Limit 110 km/h. Radar Activated at 131 km/h

Mohammed Bin Zayed Road: Limit 110 km/h. Radar Activated at 131 km/h

Important to mention that some roads may have differing speed limits along sections of the road, with need to follow the instructions given by the signs.

Important Points for Motorists

Avoid Changes: Pay close attention to the information regarding the limit and grace margin as this can change at any given time.

Maintain speed: It is crucial to respect the limit provided and look for any alteration in the route taken.

Decreasing the Speed Limit: The grace gap is within the limit given, but not something that is wanted. If the higher distance to radar activation is met, anticipate fines to follow.

Being fully aware and awake, drivers will be in a position to ensure that they are abiding by traffic rules as well as ensuring Dubai roads are safe.

Doha, Qatar – In a significant move to streamline healthcare access and modernize public services, Qatar’s Minister of Public Health, His Excellency Mr. Mansoor bin Ebrahim Al Mahmoud, issued Decision No. (46) of 2025, effectively abolishing the previous Decision No. (21) of 2023 which mandated fees for obtaining and replacing health cards .

☑️ QID as Health Documentation: Qatari citizens can now use their Qatari National ID card (QID) to access healthcare services across government facilities, including Hamad Medical Corporation (HMC) and Primary Health Care Corporation (PHCC) centers, without requiring a separate health card .

☑️ Fee Abolishment: The new decision eliminates all previously applicable fees for health card issuance, renewal, or replacement for Qatari citizens .

☑️ Residents’ Health Cards Unaffected: Health cards for expatriate residents will remain mandatory and must be used under existing procedures, including applicable fees .

This policy shift aligns with Qatar’s broader efforts to simplify administrative workflows, reduce bureaucratic redundancy, and enhance patient convenience . By integrating healthcare access with national identification, the government aims to create a seamless experience for Qatari nationals while maintaining clarity for residents.

The Ministry of Public Health has urged citizens to carry their QID at all times when visiting healthcare facilities to ensure uninterrupted services .

This update reflects Qatar’s ongoing commitment to digital transformation in public services, a key pillar of the Qatar National Vision 2030 . The earlier health card system, which involved fees (e.g., QAR 50 for Qatari adults and QAR 100 for adult residents) and multi-step application processes, has been replaced for citizens with a more efficient identity-based mechanism .

💡 Note: While this reform simplifies procedures for citizens, residents and visitors must continue following existing health card guidelines. For details on resident health card requirements, refer to the PHCC Health Card page .

DUBAI, July 14, 2025 – The lavish tale of a Dubai influencer, whose husband famously purchased a $50 million private island so she could feel comfortable wearing a bikini, takes an unexpected turn—she's pregnant.

Soudi Al Nadak, the 26-year-old British-born influencer, shot to social media fame when her husband, entrepreneur Jamal Al Nadak, bought her a private island in Asia. He cited privacy and comfort as the motive—ensuring she could enjoy a beach setting in a bikini away from prying eyes. Her revelation quickly went viral.

Now, Mashable Middle East reports the stylish influencer is expecting her first child. The update adds another layer to their extravagant lifestyle, pivoting from pure showmanship to a significant life milestone.

Known for extravagance: Soudi often highlights life’s luxuries—from million-dollar diamond rings to designer getaways—on platforms like Instagram and TikTok.

The island purchase: In 2024, Jamal reportedly bought the island as both a strategic investment and a gesture of care, wanting his wife to feel safe and free.

Pregnancy news: The couple’s latest update, now expecting a baby, shows a new, more intimate chapter in their shared journey.

The shift from a headline-grabbing island to welcoming a baby brings real emotion into their glamorous world. It’s a reminder that life’s most meaningful moments often come beyond material excess. Will they raise their child on the island? Decorate a luxurious nursery in Dubai? Either way, this news promises to add a heartfelt dimension to their online story.

DUBAI, July 12, 2025 – James Gunn’s latest Superman reboot is sparking lively conversation online, with many viewers insisting the film delivers a clear political message.

In one powerful scene, a heavily armed military force crosses a border and targets civilians—complete with dialogues hinting at an impending aerial strike. Viewers quickly drew parallels to the Israel–Gaza conflict, with social media buzzing:

“Y’all were not kidding about how anti-Israel and pro-Palestine that superman movie was, and they were not slick with it AT ALL,” posted one X (formerly Twitter) user.

Another wrote:

“Not gonna lie I really like the anti‑Israel sentiment from superman and now I know James Gunn is always standing on business.”

Though neither Gunn nor the cast have acknowledged direct references, these interpretations suggest the scene may serve as a symbolic allusion to ongoing geopolitical struggles.

Gunn has stated in interviews that his Superman reboot explores themes of “politics” and “morality,” framing the iconic hero as an immigrant grappling with global injustice. This creative choice has triggered backlash from some US conservative voices.

The film, introducing David Corenswet as Clark Kent/Superman and Rachel Brosnahan as Lois Lane, also features Nicholas Hoult as Lex Luthor and Isabela Merced as Hawkgirl. Released across Saudi Arabia on July 10, 2025, it marks the official launch of Gunn’s new DC Universe.

While James Gunn hasn’t confirmed any real-world allegories, the clear parallels drawn by early audiences reflect modern viewers’ appetite for socially conscious storytelling. Whether intentional or interpreted, the discourse speaks volumes about the power of cinema to provoke debate—even from a superhero blockbuster.

Dubai, UAE – May 24, 2025

The National Center of Meteorology (NCM) has issued a weather alert for several regions across the UAE, warning residents of dense fog and soaring temperatures this weekend.

Dense fog formations have been reported in areas such as Ghiyathi and Bada Dafas in the Al Dhafra region. The NCM cautions that visibility may drop significantly in coastal and internal areas, particularly westward, until 9 AM on Saturday. Motorists are urged to exercise extreme caution while driving during these conditions.

Following the morning fog, the country is expected to experience scorching temperatures:

Inland areas: Highs between 44°C and 48°C

Coastal regions and islands: Highs between 40°C and 45°C

Mountainous areas: Highs between 35°C and 40°C

Despite the intense heat, the overall weather is anticipated to be fair, with partly cloudy conditions in eastern parts of the country. Winds will be light to moderate, ranging from southeast to northwest at speeds of 10 to 20 km/h, occasionally gusting up to 30 km/h. Sea conditions are expected to remain slight in both the Arabian Gulf and the Oman Sea.

Residents and visitors are advised to:

Avoid outdoor activities during peak heat hours.

Stay hydrated and wear lightweight clothing.

Use sun protection when outdoors.

Drive cautiously during foggy conditions, using headlights and maintaining safe distances.

Staying informed about weather updates and adhering to safety guidelines can help mitigate risks associated with extreme weather conditions.

As we step into the second half of 2025, global financial markets are showing signs of transition. According to J.P. Morgan Private Bank’s mid-year report titled Comfortably Uncomfortable, investors should brace for potential volatility—but also be ready to seize emerging opportunities.

From shifts in global currencies to Europe’s economic comeback and AI’s rapid evolution, UAE-based investors can still build resilient, growth-focused portfolios with the right mix of strategies.

In a year filled with policy uncertainty, inflation concerns, and upcoming global elections, resilience is more than a buzzword—it’s a must. UAE investors may find value in:

Diversified hedge fund strategies: Offering potentially better returns than fixed income with reduced risk.

Equity-linked structured notes: Now used by twice as many investors in 2025 compared to last year, offering reliable income streams.

While U.S. markets contend with high valuations and political noise, Europe is accelerating thanks to strong infrastructure and defense spending—especially in Germany. UAE investors could consider reallocating part of their portfolio to:

European equities or mutual funds with a focus on long-term growth.

A gradual decline of the U.S. dollar, fueled by protectionist policies and increased fiscal spending, may present risks for dollar-heavy portfolios.

Alternative currency plays: The Euro and Japanese Yen offer stability.

Gold remains a safe-haven asset amid central bank accumulation.

With the dirham pegged to the dollar, UAE investors should consider partial exposure to non-dollar-denominated assets for added protection.

Artificial Intelligence continues to reshape global industries. In H2 2025:

Sectors like software and finance are showing real productivity gains.

Agentic AI is on the rise—poised to transform business models and slash costs.

UAE-based investors may benefit from exposure to AI-driven funds or local tech firms riding the innovation wave.

While traditional private equity slows, secondary market interest is picking up—allowing investors to buy into existing assets at potentially lower risk.

Evergreen funds, offering longer-term access and better liquidity, are also gaining popularity.

For residents and investors in the UAE, 2025 is shaping up to be a year of careful, globally-aware decision-making. Diversifying across asset classes and geographies while staying informed about AI, currency movements, and private equity trends can help preserve capital and unlock new returns.

💡 Tip: Work with a licensed financial adviser familiar with both international market dynamics and local conditions in the UAE.

The U.S. Department of Defense has formally accepted a luxury Boeing 747-8 jet from Qatar's royal family, intended for use as an interim Air Force One for President Donald Trump. The aircraft, valued at approximately $400 million, will undergo extensive modifications to meet the stringent security and communication requirements necessary for presidential transport.

Defense Secretary Pete Hegseth confirmed the acceptance, stating that the aircraft was received in accordance with all federal regulations. The Air Force has been directed to initiate plans for retrofitting the jet, although specific details regarding the modifications remain classified.

President Trump defended the decision, emphasizing the practicality of utilizing the gifted aircraft amidst delays in the delivery of new presidential planes ordered from Boeing in 2018. He noted that the Qatari jet would serve as a temporary solution until the new aircraft are operational.

However, the acceptance of the jet has sparked bipartisan concerns over potential violations of the U.S. Constitution's Emoluments Clause, which prohibits federal officials from receiving gifts from foreign governments without congressional approval. Critics argue that the arrangement could pose national security risks, including the possibility of embedded surveillance equipment.

Qatari Prime Minister Sheikh Mohammed bin Abdulrahman Al Thani characterized the gift as a standard diplomatic gesture, denying any ulterior motives.

The aircraft's retrofit is expected to be a complex and costly process, potentially exceeding $1 billion and taking several years to complete. Despite the controversy, the Pentagon maintains that all procedures have been conducted in compliance with federal guidelines.

As the situation unfolds, lawmakers continue to scrutinize the decision, weighing the benefits of the interim solution against the ethical and security implications of accepting such a significant gift from a foreign government.

Dubai, UAE – May 20, 2025

As Eid Al Adha 2025 approaches, UAE residents are strategizing to maximize their holiday time. With the official public holiday spanning four days, many are considering taking additional leave to extend their break.

According to the UAE's public holiday calendar, Arafah Day is expected on Thursday, June 5, 2025, followed by Eid Al Adha from Friday, June 6 to Sunday, June 8. This provides a four-day weekend for most residents.

To extend the holiday, residents are exploring options:

Nine-Day Break: By taking leave from Monday, June 2 to Wednesday, June 4, employees can enjoy a nine-day break from June 2 to June 8.

Fifteen-Day Break: Taking leave from Monday, June 2 to Monday, June 16 allows for a 15-day vacation, utilizing nine days of annual leave.

Twelve-Day Break: Applying for leave from Monday, June 9 to Monday, June 16 results in a 12-day break, using six days of annual leave.

With the extended break, many residents are planning short getaways to nearby GCC countries. Destinations like Muscat, Jeddah, and Abu Dhabi are popular choices, offering quick escapes without extensive travel.

Dubai, UAE – May 19, 2025

Despite successive rent hikes, a significant number of Dubai tenants are choosing to renew their leases rather than seek new accommodations, citing cost-effectiveness and market dynamics as primary reasons.

Feedback from leasing agencies and property portals indicates that renewing existing rental contracts remains more economical for tenants, even with increases exceeding 10%. The expenses associated with moving—such as agency fees, relocation costs, and utility setups—often outweigh potential savings from new leases.

Rashed Hareb, CEO of Rentify, notes that nearly 90% of tenants on their platform opt for renewals, highlighting the financial and logistical challenges of relocating.

Six months into the implementation of Dubai's digital Rental Index, the rental landscape continues to evolve. The Index's star rating system allows landlords of newly completed properties to command higher rents, contributing to a rental premium in the market. Consequently, tenants find that staying put is often the more financially prudent choice.

With tens of thousands of new residential units expected to enter the market in the coming months, there is anticipation about potential shifts in rental dynamics. However, current trends suggest that landlords maintain leverage, with high demand and limited negotiation room for new listings.

Dubai, UAE – May 18, 2025

The UAE-India Property Show concluded its second day at the Millennium Plaza Downtown Hotel on Sheikh Zayed Road, witnessing a consistent influx of visitors eager to explore diverse real estate opportunities in both the UAE and India.

The exhibition showcased a wide array of properties, from affordable housing to luxury villas and commercial spaces. Developers from major Indian cities like Mumbai, Pune, Bengaluru, Hyderabad, Chennai, and Delhi NCR presented their flagship projects, attracting investors seeking lucrative opportunities.

Hameed Fayaz, Sales Manager at DP World, emphasized the significance of such events for market research and investment planning. He is considering a Dh2 million townhouse in Dubai, aiming to secure a Golden Visa for his family.

Sreenivasu Konda, Deputy General Manager at Aries Group of Companies, expressed interest in diversifying his investments by exploring commercial properties in Hyderabad. He highlighted the convenience of accessing firsthand information in a professional setting.

Shyam Agarwalla, Managing Director of Glaze Services, found the event beneficial for understanding market rates and new offerings, especially for his land holdings in Bengaluru.

Exhibitors enticed visitors with special discounts up to a million rupees, attractive deals, and even gold coins for UAE investors, enhancing the appeal of the property show.

Dubai, UAE – May 19, 2025

Residents across the United Arab Emirates are experiencing a gradual increase in temperatures, accompanied by foggy conditions in certain areas, according to the National Center of Meteorology (NCM).

Daytime temperatures are expected to range between 34°C and 38°C, while nighttime lows will be between 20°C and 25°C. These conditions are typical for this time of year, signaling the onset of the hotter months ahead.

The NCM has issued fog alerts for areas including Al Wathba in Abu Dhabi, Sheikh Maktoum bin Rashid Road, and Sheikh Zayed Road. There is a probability of fog or mist formation over some coastal and internal areas on Tuesday morning, May 20.

Light to moderate winds are expected across the country today, with speeds reaching up to 30 km/h. These winds may contribute to the dispersal of fog in affected areas.

Motorists are advised to exercise caution during early morning hours due to reduced visibility caused by fog. It's recommended to use fog lights and maintain a safe distance between vehicles.

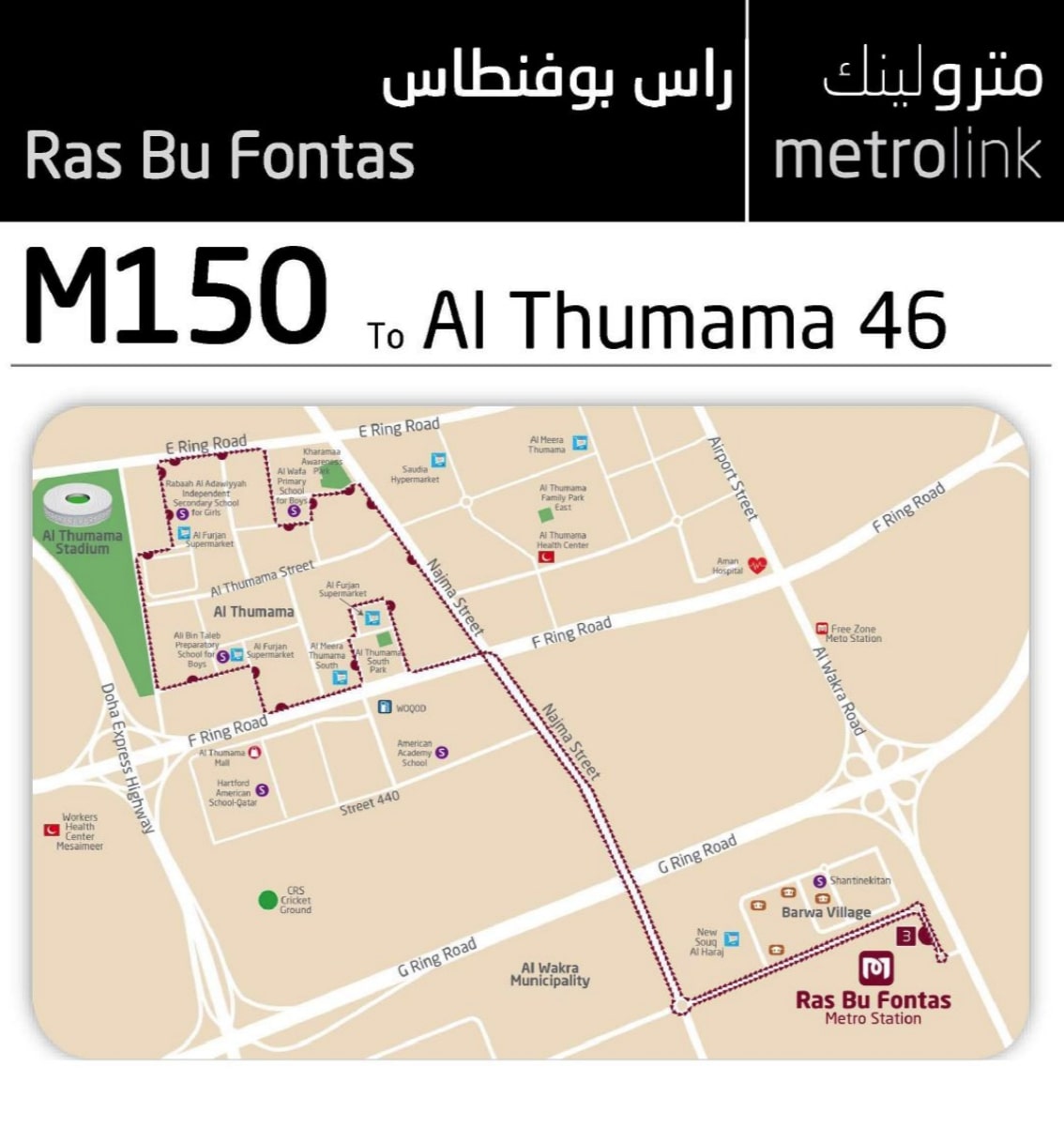

Doha Metro & Lusail Tram has announced the launch of a new metrolink route, offering enhanced connectivity for commuters in the capital. Effective May 18, the M150 metrolink bus service will operate from Ras Bu Fontas Metro Station to Al Thumama 46, providing a convenient transport option for residents and visitors in the area.

The newly introduced route is part of the ongoing efforts to improve last-mile connectivity and make public transportation more accessible and efficient across Doha. The M150 route is expected to serve key residential and commercial zones, supporting daily commuters with seamless links between metro services and nearby destinations.

Passengers traveling from Ras Bu Fontas Station can now use the M150 service to reach Al Thumama 46 without the need for additional transport arrangements, significantly improving travel convenience in this corridor.

For more information and real-time updates, travelers are encouraged to use the official Doha Metro & Lusail Tram mobile app or visit the Doha Metro website.

Source: Doha Metro & Lusail Tram

As UAE residents plan their summer getaways to Europe, many may be caught off guard by a new expense: European tourist taxes. These fees, often added as “eco contributions” or “sustainability levies,” are increasingly appearing on hotel bills and even as entry charges for day visitors.

Experts warn that these hidden charges could add Dh480 or more to a family’s vacation budget. From hotel stays to cruise port visits, popular European cities such as Venice, Barcelona, and Rome are applying taxes to help manage overtourism and fund environmental protection.

Hotel guests, day-trippers, and cruise passengers may all be subject to different local taxes.

Common terms include: eco tax, clean air fee, sustainability charge, and sojourn fee.

Fees vary by city and are often not included in initial bookings.

Travellers are advised to research local tax policies before booking to avoid surprises.

Local governments argue that the revenue supports infrastructure maintenance and helps reduce the environmental toll of mass tourism. However, the lack of transparency around these taxes has raised concerns among tourists.

To avoid unexpected costs, UAE residents are encouraged to check local tourism websites or hotel booking platforms for up-to-date tax details at their destinations.

Here's a breakdown of some of the unexpected tourist taxes in Europe:

Venice, Italy: The City Access Fee, also known as a Day Visitor Tax, applies even to those not staying overnight. It costs Dh24 per person per day.

Balearic Islands, Spain: A Sustainable Tourism Tax is in place, ranging from Dh4.87 to Dh19.4 per night.

Barcelona, Spain: Visitors face a Tourism Tax, and cruise passengers pay a supplement. The tourism tax is Dh13.4 per night, and the cruise supplement is Dh14.6.

Ljubljana, Slovenia: An Environmental Surcharge, collected through hotels, is approximately Dh9.7 per night.

Amsterdam, Netherlands: Toeristenbelasting applies, and there's an additional charge related to air quality. The hotel tax is 7% of the room rate.

Dubrovnik, Croatia: A Sojourn Tax contributes to general tourist infrastructure, costing around Dh.7.31 per night

Vienna, Austria: A Local Levy (Ortstaxe) for tourism promotion and maintenance is 3.2 per cent of the room rate

Paris, France: The Taxe de Séjour varies with hotel star rating, ranging from Dh4.87 to Dh24.3 per night

Santorini, Greece: A Stayover Tax is tiered by accommodation rating, from Dh2.4 to Dh19.4 per night

Reykjavik, Iceland: An Accommodation Tax for a government tourism fund costs Dh 8.4 to Dh 16.86

Portugal (Lisbon, Porto): A Municipal Tourism Tax for local development is Dh9.7 per night

Rome, Italy: The Tourist Contribution varies by accommodation category, from Dh14.6 to Dh34.1 per night

Switzerland (Zermatt): The Kurtaxe covers air, view, and tourism costs, even for mountain huts, and ranges from Dh9.74 to Dh17.05

Germany (Cologne, Berlin): A City Tax or Culture Tax for local culture, museums, and events is 5 per cent of the room rate

Malta: The Eco Contribution for environmental protection is Dh2.44 per night, with a maximum of Dh24.3.

Source: Gulf News